Minimum Attractive Rate of Return Definition

The first expression is the MARR which is the Minimum-Attractive Rate of Return If you have the interest to borrow from your cousin to start a new business to open a coffee business. Up to 5 cash back An organizations minimum attractive rate of return MARR is just that the lowest internal rate of return the organization would consider to be a good investment.

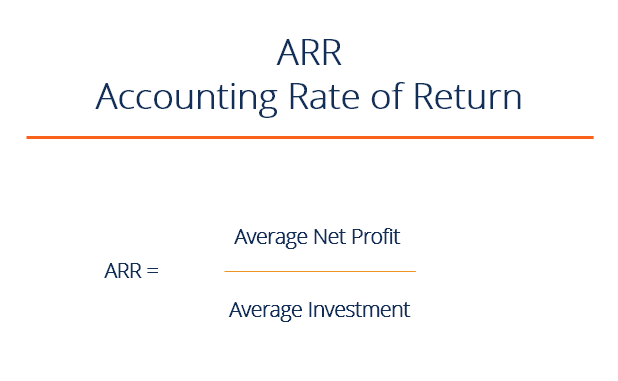

Arr Accounting Rate Of Return Guide And Examples

The MARR is a statement that an organization is confident it can achieve at least that rate of return.

. 4 against next alternative ie. Another way of looking at the MARR is that it represents the organizations opportunity cost for. An investor typically sets the required rate of return by adding a risk premium to the interest percentage that could be gained by.

A synonym seen in many contexts is minimum attractive rate of return. So as a rule of thumb you need to remember the following very very very carefully. Since the AW value is the equivalent uniform annual worth of all.

0 -60000 25000 PA i 4 PA i 4 24000. Minimum Attractive Rate of Return for Public Investment Author. That will then tell us that the MARR the Minimum Attractive Rate of Return in your case would be 50.

Rate of Return New Value of Investment - Old Value of Investment x 100 Old Value of Investment. Find the rate of return on the difference column. The required rate of return is the minimum return an investor expects to achieve by investing in a project.

Illustrated in this module is drawing a cash flow diagram. Rate of return Current value Initial value Initial value 1 0 0 textRate of return fractextCurrent value - textInitial valuetextInitial valuetimes 100. The tabulation of cash flow is left to the student The rate of return equation is.

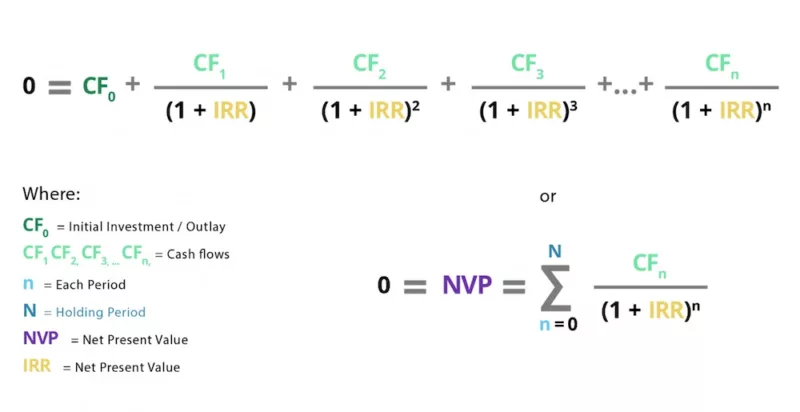

Executives analysts and investors often rely on internal-rate-of-return IRR calculations as one measure of a projects yield. Calculating simple and compound interest rates are covered along with distinguishing between nominal and effective interest rates. A hurdle rate which is also known as the minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

For many engineering economic studies the AW method is the best to use when compared to PW FW and rate of return Chapters 6. Spreadsheets use in engineering economy. Private-equity firms and oil and gas companies among others commonly use it as a shorthand benchmark to compare the relative attractiveness of diverse investments.

In terms of decision making if the ARR is equal to or greater than a companys required rate of return Hurdle Rate Definition A hurdle rate which is also known as minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment. Learn about the formula and calculation of RRR in the capital assets pricing. A discussion of methods of determining a minimum attractive rate.

Economic Rates of Return ERRs provide a single metric showing how a projects economic benefits compare to its costs. The required rate of return RRR is the minimum amount of return that is expected to be received on an investment. The formula for CAGR is.

Accountability and transparency are key principles of MCCs evidence-based approach to reducing poverty through economic growth. CAGR EVBV 1n - 1. In business and for engineering economics in both industrial engineering and civil engineering practice the minimum acceptable rate of return often abbreviated MARR or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project given its risk and the opportunity cost of forgoing other projects.

Professor Ibrahim Odeh discusses the Mathematics of Money beginning with a definition of the Time Value of Money. A minimum acceptable rate of return MARR is the minimum profit an investor expects to make from an investment taking into account the risks of the investment and the opportunity cost of undertaking it instead of other investments. If the interests on your investment is less than your MARR then the investment to you is not profitable to your company its not profitable.

The internal rate of return is the amount above. MARR You must still have a return of more than that 10 at least 11 to make business otherwise you will lose in the future so the MARR is the minimum to safeguard. 0 -30000 9000 PA i 4 PA i 4 33333 i is between 7 and 8 Since i 12 eliminate 2.

1600 20 Web Discount. Economic Rates of Return. If the investment is foreign then changes in exchange rates will also affect the rate of return.

A discussion of methods of determining a minimum attractive rate of return for public investments. A project is not economically viable unless it is expected to return at least the MARR. EV The investments ending value.

Minimum Attractive Rate of Return MARR. Compounded annual growth rate CAGR is a common rate of return measure that represents the annual growth rate of an investment for a specific period of time. The Minimum Attractive Rate of Return MARR is a reasonable rate of return established for the evaluation and selection of alternatives.

In order to clarify the fundamental logic of interest the first part of this paper considers a riskless world in which there would be no uncertainty and hence no distinction between equity. The rate is determined by assessing the cost of capital Unlevered Cost of Capital Unlevered cost of capital is the theoretical cost of a company financing itself for. The hurdle rate is the minimum rate of return on an investment that will offset its costs.

MCC requires that its projects ERRs pass a 10 percent hurdle. Projects with the highest IRRs are considered. MARR is also referred to as the hurdle rate cutoff rate benchmark rate and minimum acceptable rate of return.

Minimum acceptable rate of return Edit In business and engineering the minimum acceptable rate of return often abbreviated MARR or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project given its risk and the opportunity cost of forgoing other projects.

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

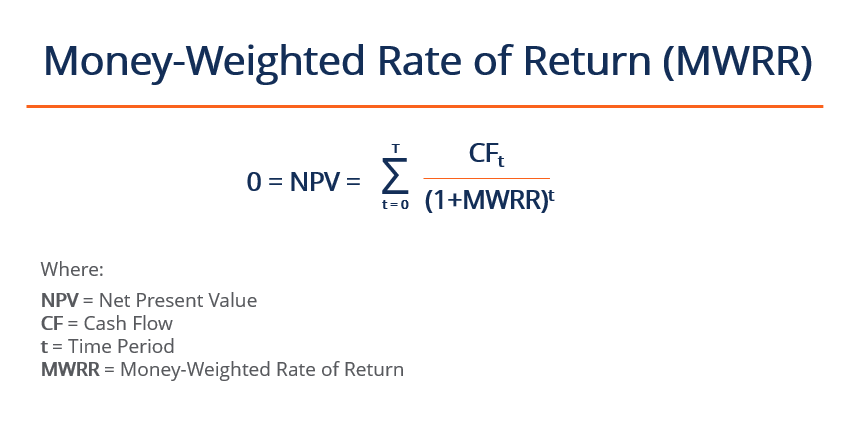

Money Weighted Rate Of Return Mwrr Overview Formula Example

Comments

Post a Comment